The effectiveness with which a company conducts its logistics operations is measured by its logistics efficiency. To make sure that customers receive their orders swiftly and affordably, online merchants must carefully monitor and optimise the movement of product shipments. A challenging aspect of supply chain management is logistics. Logistics issues like truck breakdowns and rising tariffs will certainly be a problem for new internet businesses that want to grow quickly.

E-commerce logistics costs include all fees associated with the shipping and storage of goods, including those for gasoline, warehousing, depreciation, insurance, taxes, and labour. Most of these expenses have increased after COVID-19, which makes quick and dependable shipping quite pricey. The profitability of your online retail firm is therefore impacted by this. Much of this difficulty is being felt by smaller retailers who sell bulky, heavy, and low-value items.

A manager must monitor KPIs including on-time shipment, warehouse capacity, order fulfilment accuracy, product damage, and personnel turnover rate to gauge logistics efficiency.

The efficacy of a company’s operations and the efficient use of resources to accomplish those goals are referred to as logistics efficiency. An organization’s operational effectiveness is referred to as its logistical efficiency. Logistics often deals with the transportation of tangible items and important data. A company with effective logistics can track product shipments and deliver goods or information quickly to the right places. This has several significant effects on marketing, which is frequently linked to logistical plans.

Infrastructure, services (digital technology, processes, and regulatory framework), and human resources all have a role in how efficiently logistics are run. A multimodal connectivity infrastructure National Master Plan (NMP) for PM GatiShakti’s economic zones has been launched in India. In order to ensure first and last mile connectivity and smooth movement of people and goods, it integrates existing and proposed infrastructure development initiatives from various agencies. This is a transformative approach for increasing logistics efficiency and reducing logistics cost.

While the PM GatiShakti National Master Plan is intended to address the development of integrated infrastructure and network planning, the National Logistics Policy is the obvious next step for efficiency in services (processes, digital systems, regulatory framework, and human resource). This will offer a thorough development schedule for the entire logistics ecosystem.

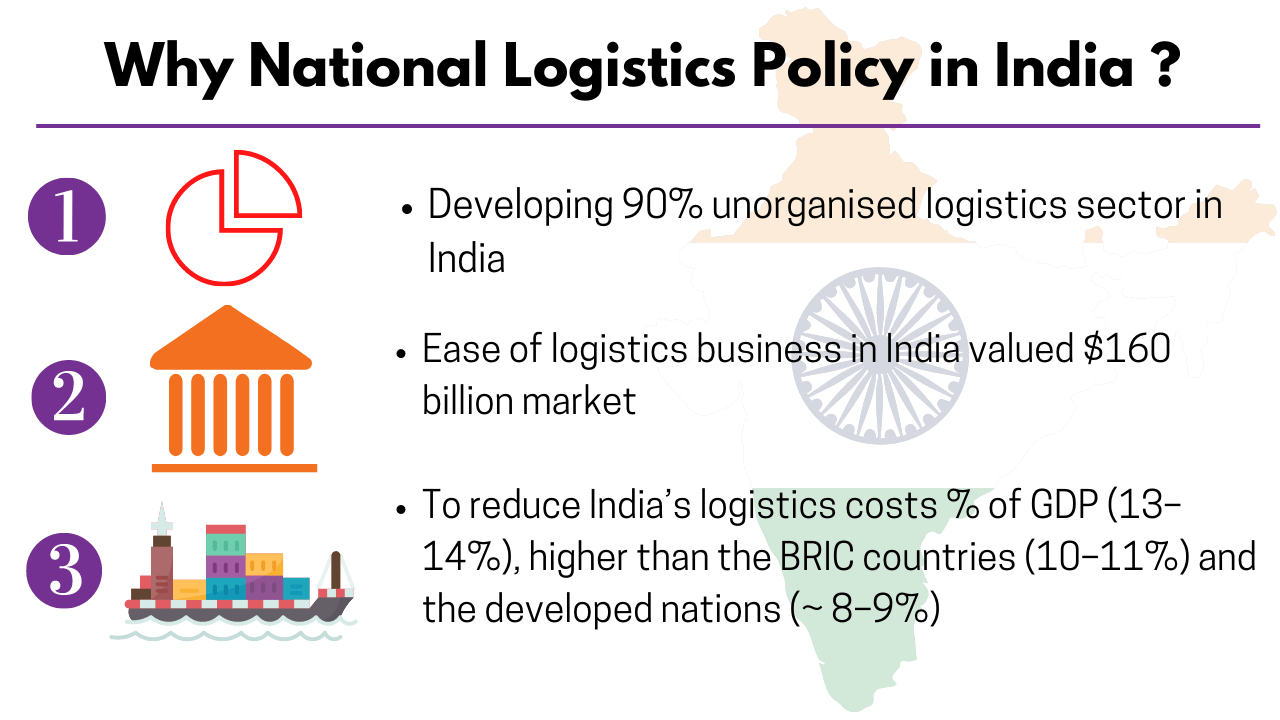

On 17th September 2022, the Government of India unveiled a new “National Logistic Policy.” The objective is to lower logistical costs nationwide, boost productivity, shorten transit times, etc. By financial year 2030, the government of India wants to bring the cost of logistics down from 13% to 14% of GDP.

According to the Ministry of Road Transport and Highways, India’s logistics costs as a percentage of GDP are 13–14%, higher than the BRIC countries’ 10–11% and the developed nations’ 8–9%. The logistic market in India, which includes warehousing, cold storage, rail freight terminals, and road and rail transportation, is anticipated to expand at a CAGR of 10% to reach INR 15 trillion by fiscal 2026. The Indian government made clear that it wants to rank among the top countries for the logistics sector. The improvement of exports and decrease in domestic product costs will be made possible by the reduction of logistic costs.

The government started taking different actions to improve sector efficiency before announcing the national logistic policy. For instance, faceless assessment at customs has been implemented, and e-sanchit has enabled paperless export-import trade processes. E-way bills and FASTag are also used on highways to increase productivity. The GatiShakti national master plan, Sagarmala, Bharatmala, and Dedicated Freight Corridor are only a few of the government’s initiatives to improve infrastructure.

India sets ambitious export goals and meets them as well. India is becoming a major global base for manufacturing. The capacity of Indian ports has greatly expanded. Container ships now turn around on average in 26 hours instead of 44, as previously. The Unified Logistics Interface Platform (ULIP) consolidates all digital transportation services into a single interface, relieving exporters of a number of extremely time-consuming and onerous procedures.

These elements are anticipated to lower logistics costs and boost logistic efficiencies in India together with the updating of the national logistic policy. This will eventually support the economy across sectors in a variety of ways to become a manufacturing powerhouse on a global scale. Understanding the Indian logistics sector, particularly the e-commerce logistics market, is necessary to comprehend the top 5 logistic stocks in India. We want to talk about logistic stocks that we can hold for a long time and invest in.

With a 24% CAGR from 2021 to 2025, the Indian e-commerce logistics industry is anticipated to reach INR 500 billion, driven by rising demand from tier II cities and the use of technology to supply chain management. In the coming five years, the e-commerce logistics industry will develop even more as buying habits change and internet usage rises.

The user experience in the logistical e-commerce sector has altered as a result of the application of technology such as artificial intelligence (AI), blockchain, and big data analytics. For 2022–2023, the Indian government would spend INR 20,000 crores on Gati Shakti, a nationwide initiative to boost the nation’s logistical infrastructure. The extremely fragmented Indian logistics sector will advance faster if the government focuses on integrated logistics and multimodal connectivity.

According to the Economic Survey for 2021–2022; Indian economy is anticipated to increase by 8 to 8.5 percent throughout the upcoming fiscal year of 2022–2023. Further, to reach a $5 trillion economy by FY 2025–2026, India must grow at a CAGR of 8%. By 2026, India will need a robust logistics sector and infrastructure to support this expansion.

India spends the least per capita GDP on logistics compared to China and the United States. The top ten logistic companies in India barely account for 1.5% of the market, indicating the logistic sector’s extreme lack of organisation. While most Indian logistic companies are regional or vertically oriented, this presents a significant potential for organised players to go global and gain market dominance.

There are both listed and unlisted logistic enterprises in India. Investors may track top 5 logistics stocks which are listed on both the BSE and NSE exchanges in India.

Top 5 logistic stocks to keep on track

| Top 5 Logistic Stocks (Companies) | Market Cap (INR Cr. ) | Revenue-FY22 (INR Cr.) | Debt to Equity |

| Container Corporation of India Ltd. (Concor) | 45009 | 7652 | 0.01 |

| Blue Dart Express | 20207 | 4410 | 0.23 |

| Allcargo Logistics Ltd | 9806 | 20072 | 0.59 |

| Aegis Logistics Ltd. | 9891 | 4630 | 0.18 |

| TCI Express Ltd. | 7252 | 1081 | 0 |

These top 5 logistics stocks or businesses have a solid financial foundation. All the top 5 logistic stocks mentioned above have shown an increase in revenue over time. When it comes to warehousing and the supply chain, India is still under-represented. After the National Logistic Policy’s introduction, the market has a favourable outlook on logistics companies.

Based on my overall understanding of the logistics industry one may invest in stocks of Container Corporation of India Ltd. (Concor) and Allcargo Logistics Ltd.